Mercedes-Benz Mobility AG

Siemensstr. 7

70469 Stuttgart

Deutschland

Tel.: +49 711 17 0

E-Mail: mobility@mercedes-benz.com

Please send queries about content on this website to any contact. You can address your concerns to us in English and your respective national language.

Represented by the Board of Management: Franz Reiner (Chairman), Jörg Lamparter, Susann Mayhead, Tolga Oktay, Peter Zieringer

Chairman of the Supervisory Board: Harald Wilhelm

Commercial Register Stuttgart, No. HRB 737788

VAT registration number: DE 81 11 20 930

Daimler AG (ticker symbol: DAI) today reported its results for the first quarter ended March 31, 2020. Here you will find all important results relating to the Daimler Group and the Daimler Mobility division.

The Group’s total unit sales decreased by 17% to 644,300 passenger cars and commercial vehicles (Q1 2019: 773,800) due to the global spread of the corona virus. Revenue slipped slightly by 6% to €37.2 billion (Q1 2019: €39.7 billion). First-quarter EBIT was €617 million (Q1 2019: €2,798 million). Adjusted EBIT, reflecting the underlying business, was €719 million (Q1 2019: €2,310 million).

In the first quarter of 2020, net profit was €168 million (Q1 2019: €2,149 million). Net profit attributable to the shareholders of Daimler AG amounted to €94 million (Q1 2019: €2,095 million), leading to a decline in earnings per share to €0.09 (Q1 2019: €1.96).

"The COVID-19 pandemic has substantial effects on the global economy - and our company. We took the proactive decision to stop production in March, and moved very quickly into cash preservation and cost management mode. As a consequence, Daimler ended the first quarter with a positive result and a robust liquidity. Now we have started with a gradual ramp-up of our production. At the same time, we are continuing to invest in key technologies, including electrification and digitalization. They are non-negotiable elements of our future."

Ola KälleniusChairman of the Board of Management of Daimler AG and Head of Mercedes-Benz Cars

The effects of the virus pandemic and the resulting decrease in unit sales led to a significant earnings downturn at Mercedes-Benz Cars & Vans as well as Daimler Trucks & Buses. Earnings at Daimler Mobility were also negatively impacted by additional expenses for credit risk provisions in connection with the pandemic.

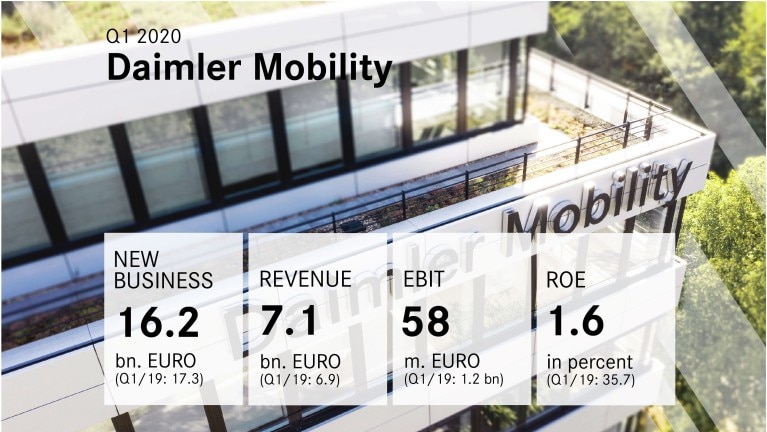

At Daimler Mobility, new business decreased by 7% to €16.2 billion in the first quarter (Q1 2019: €17.3 billion). Contract volume was €159.6 billion at the end of the quarter (December 31, 2019: €162.8 billion). Revenue was €7.1 billion (Q1 2019: €6.9 billion). The division’s EBIT amounted to €58 million (Q1 2019: €1,209 million). At 1.6%, return on equity was lower than the figure of 35.7% in the prior-year period. Adjusted EBIT was €58 million (Q1 2019: €491 million) and adjusted return on equity was 1.6% (Q1 2019: 14.5%).

After the world economy was already burdened in the course of the first quarter, its development would continue to be dominated by the corona pandemic during the rest of the year. The decisive factors will be when the pandemic will be under control worldwide, how long economic activity is limited until then, and which pattern of recovery will occur afterwards. From today’s perspective, a significant decline in global economic output must be anticipated for the year 2020 as a whole.

Given the continuing effects of the pandemic, Daimler believes that the original forecast for the financial year 2020, as disclosed in connection with annual report 2019, is no longer valid.Therefore as already disclosed, Daimler expects for the Group and for Mercedes-Benz Cars, Mercedes-Benz Vans, Daimler Trucks and Daimler Buses unit sales in 2020 to be below the levels of the previous year. Daimler Mobility expects for the financial year 2020 a lower new business volume than in 2019.

Given the anticipated market development and the assessment of our divisions, Daimler expects Group revenue and Group EBIT for the financial year 2020 to be below the prior year. As the EBIT of the Mercedes-Benz Cars & Vans division was adversely affected by substantial special items in 2019, EBIT for this division is anticipated above the prior-year level despite the effects of the pandemic. The adjusted return on equity of Daimler Mobility for the financial year 2020 will not reach the prior year level. The expected decline in the results should lead to a decrease in the Group´s industrial free cash flow for 2020.

Having implemented a comprehensive set of cash protection measures and having increased the financial flexibility, Daimler is confident being well positioned to manage the business, both during and after the pandemic. As part of the measures already initiated to secure liquidity and reduce costs, Daimler will also reduce its spending on property, plant and equipment as well as on research and development compared with the previous year. However, Daimler will maintain upfront investments that are necessary to secure the future of company.

Further Information: Mercedes-Benz.com