Mercedes-Benz Mobility AG

Siemensstr. 7

70469 Stuttgart

Deutschland

Tel.: +49 711 17 0

E-Mail: mobility@mercedes-benz.com

Please send queries about content on this website to any contact. You can address your concerns to us in English and your respective national language.

Represented by the Board of Management: Franz Reiner (Chairman), Jörg Lamparter, Susann Mayhead, Tolga Oktay, Peter Zieringer

Chairman of the Supervisory Board: Harald Wilhelm

Commercial Register Stuttgart, No. HRB 737788

VAT registration number: DE 81 11 20 930

Here you can find the interim reports of Mercedes-Benz Mobility (Daimler Mobility until 2021).

![[q1_2025_de:MEDIASTORE_LEAF]@77b46adb](/images/mbm-relaunch/who-we-are/key-figures/q1-2025-en_ratio_16x9_s.jpg)

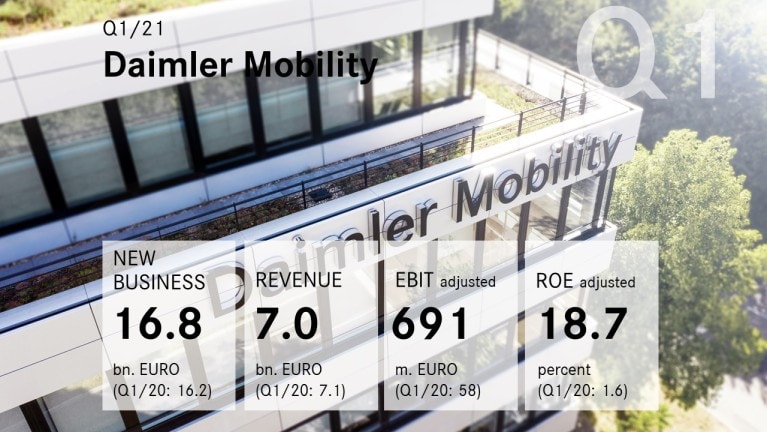

Mercedes-Benz Mobility reported a total contract volume of €133.7 billion (end of Q4 2024: €138.1 billion). New business reached €13.6 billion (Q1 2024: €14.8 billion), influenced by the dynamic financial services sector, particularly in China. However, the division recorded a higher average financing and leasing volume per contract.

The adjusted EBIT amounted to €287 million and was thus at the same level as the previous year (Q1 2024: €279 million), further investments in charging activities have been compensated by continued strict cost discipline and efficiency measures. As a result, the adjusted return on equity (RoE) reached 8.6% (Q1 2024: 8.5%).

![[q3_2024_de:MEDIASTORE_LEAF]@318c11b9](/images/mbm-relaunch/who-we-are/key-figures/q3-2024_ratio_16x9_s.jpg)

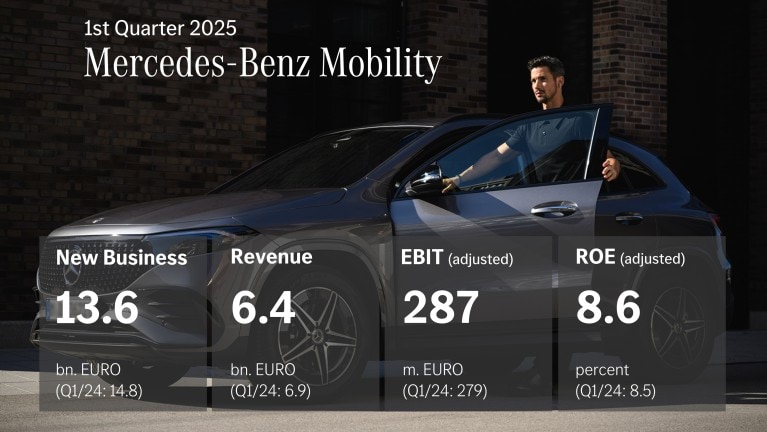

The adjusted EBIT for Mercedes-Benz Mobility decreased to €285 million mainly driven by a lower interest margin (Q3 2023: €363 million). The interest margin was impacted by the interest rate development in a competitive environment. As a result, the adjusted return on equity (RoE) reached 8.9% (Q3 2023: 10.4%).

![[q2_2024:MEDIASTORE_LEAF]@59ca8d40](/images/mbm-relaunch/who-we-are/key-figures/q2-2024_ratio_16x9_s.jpg)

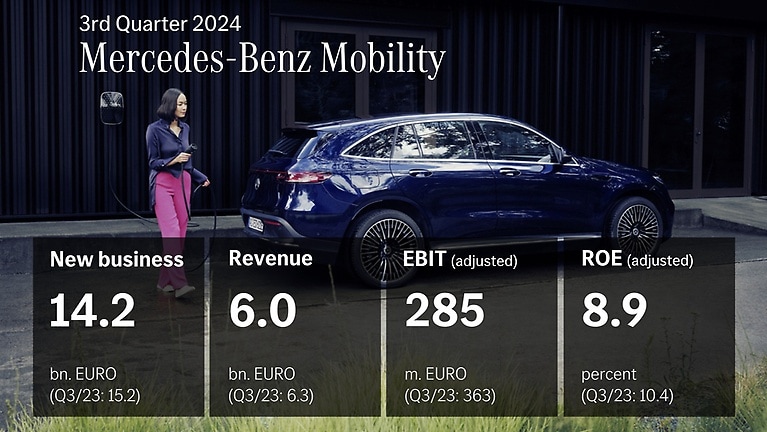

The portfolio of Mercedes-Benz Mobility shows an increasing share of xEV vehicles (battery electric vehicles and plug-in hybrid vehicles) in the second quarter of 2024. As a result, more than every second electric vehicle is now leased or financed by Mercedes-Benz Mobility.

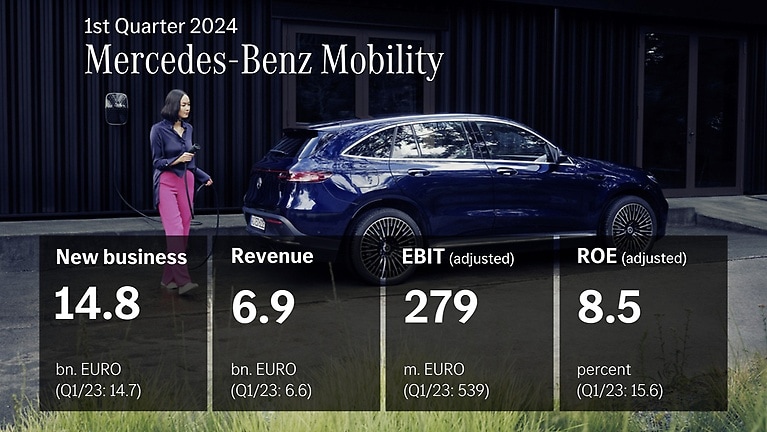

![[q1_2024:MEDIASTORE_LEAF]@31a347ff](/images/mbm-relaunch/who-we-are/key-figures/q1-2024_ratio_16x9_s.jpg)

Compared to the first quarter of the previous year, Mercedes-Benz Mobility almost doubled its new business volume for BEVs to €2.0 billion (Q1 2023: €1.2 billion).

![[q3_2023:MEDIASTORE_LEAF]@19c4ab5e](/images/mbm-relaunch/who-we-are/key-figures/q3-2023_ratio_16x9_s.jpg)

In the third quarter of 2023 Mercedes-Benz Mobility’s new business increased to €15.2 billion and is above the level of the prior-year period (Q3 2022: €14.3 billion).

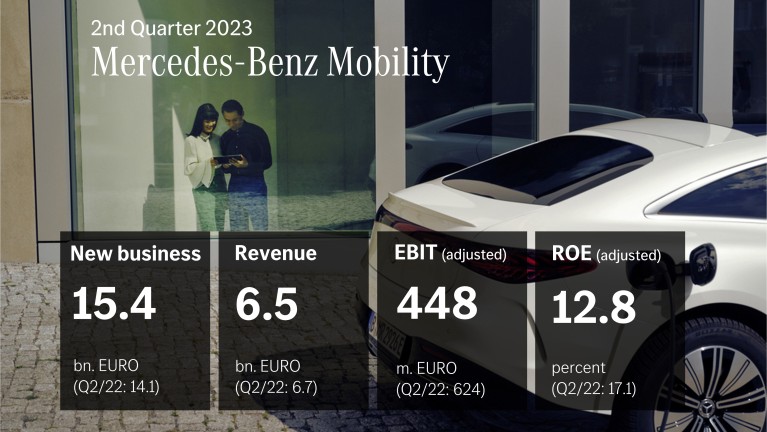

![[q1_1:MEDIASTORE_LEAF]@6f466147](/images/mbm-relaunch/who-we-are/key-figures/q2-2023_ratio_16x9_s.jpg)

Mercedes-Benz Mobility tripled new business volume for BEVs (battery electric vehicles) to €1.8 billion (Q2 2022: €0.6 billion).

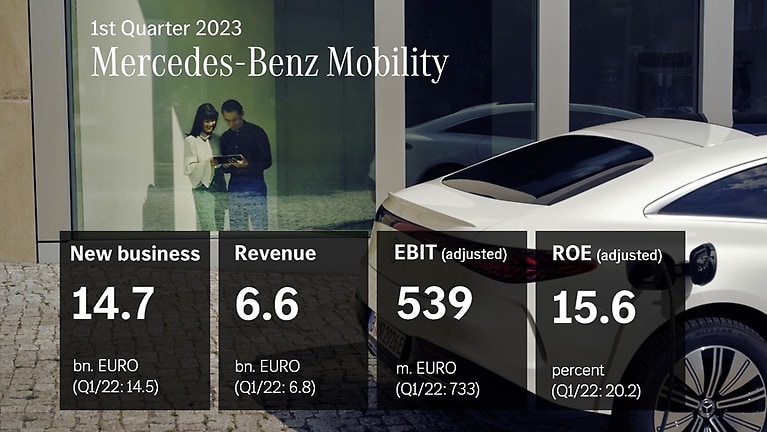

![[q1_2023:MEDIASTORE_LEAF]@11a7b96a](/images/mbm-relaunch/who-we-are/key-figures/q1-2023_ratio_16x9_s.jpg)

Compared to the first quarter of the previous year, Mercedes-Benz Mobility was able to more than double the new business volume for BEVs (battery electric vehicles) to €1.2 billion (Q1 2022: €0.5 billion).

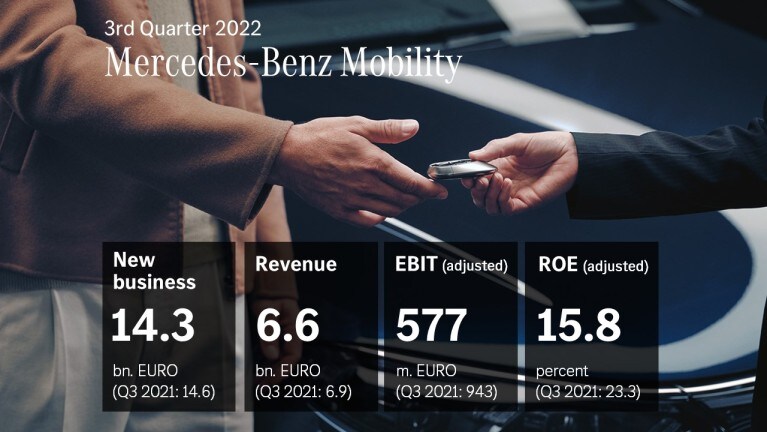

![[q3_2022:MEDIASTORE_LEAF]@43e26879](/images/mbm-relaunch/who-we-are/key-figures/q3-2022_ratio_16x9_s.jpg)

In the third quarter of 2022, Mercedes-Benz Mobility reached an adjusted Return on Equity (RoE) of 15.8%. The new business of Mercedes-Benz Mobility declined slightly by 3% to €14.3 billion compared to the prior-year’s quarter.

![[q2_2022:MEDIASTORE_LEAF]@6891ab08](/images/mbm-relaunch/who-we-are/key-figures/q2-2022/q2-2022_ratio_16x9_s.jpg)

The secondquarter of 2022 shows us that we can perform well even in a dynamic and challenging environment if we work attentively, work as a team and pull in the same direction.

![[mobility_q1_2022_teaser_v2_de:MEDIASTORE_LEAF]@19897851](/bilder/mbm-relaunch/kennzahlen/q1-2022/mobility_q1-2022_teaser-v2_de_ratio_16x9_s.jpg)

The first quarter of 2022 shows us that we can perform well even in a dynamic and challenging environment if we work attentively, work as a team and pull in the same direction.

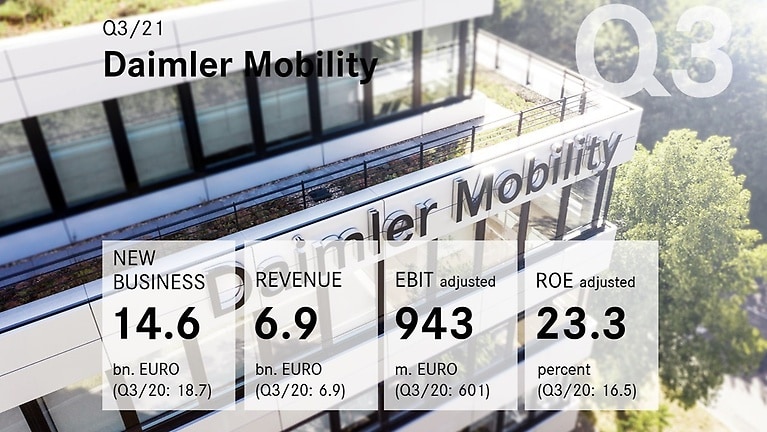

![[zwischenbericht_q3_1:MEDIASTORE_LEAF]@31741aa1](/images/mbm-relaunch/who-we-are/key-figures/interim-report-q3-2021_ratio_16x9_s.jpg)

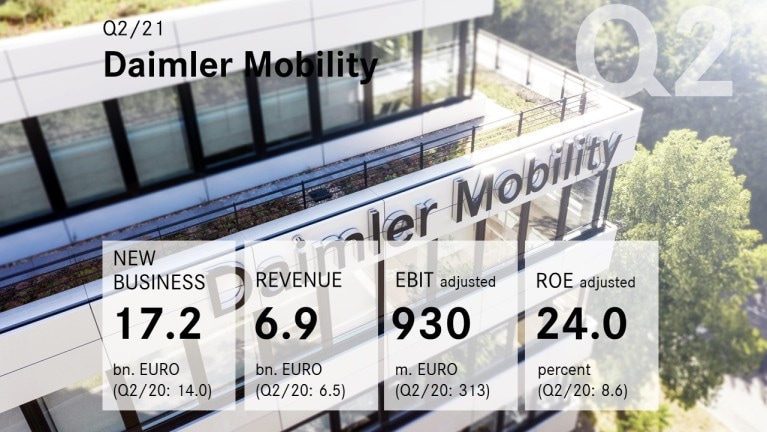

![[zwischenbericht_q2_2021:MEDIASTORE_LEAF]@497b87ba](/company/key-figures/interim-reports/q2-2021/interim-report-q2-2021_ratio_16x9_s.jpg)

![[zwischenbericht_q1_2021:MEDIASTORE_LEAF]@5bf454d1](/company/key-figures/interim-reports/q1-2021/interim-report-q1-2021_ratio_16x9_s.jpg)