Mercedes-Benz Mobility AG

Siemensstr. 7

70469 Stuttgart

Deutschland

Tel.: +49 711 17 0

E-Mail: mobility@mercedes-benz.com

Please send queries about content on this website to any contact. You can address your concerns to us in English and your respective national language.

Represented by the Board of Management: Franz Reiner (Chairman), Jörg Lamparter, Susann Mayhead, Tolga Oktay, Peter Zieringer

Chairman of the Supervisory Board: Harald Wilhelm

Commercial Register Stuttgart, No. HRB 737788

VAT registration number: DE 81 11 20 930

Mercedes-Benz Group AG’s (ticker symbol: MBG) sharpened focus on high-end passenger cars and premium vans, combined with tight cost control, helped to lift Earnings Before Interest and Taxes (EBIT) by 28% to €20.5 billion (2021: €16.0 billion) last year, outpacing a 12% rise in revenue to €150.0 billion (2021: €133.9 billion) during the same period.

In its first year after the Daimler Truck spin-off, Mercedes-Benz Group continued its transformation amid geopolitical and macroeconomic challenges. Strong results underline the improved profitability, even as the COVID-19 pandemic and semiconductor supply-chain bottlenecks and the fallout from Russia’s war against Ukraine continued to affect the business.

"We have redesigned Mercedes-Benz to be a more profitable company thanks to our focus on desirable products and disciplined margin and cost management. We cannot control macro or world events, but 2022 is a case in point that we are moving in the right direction.

In addition to delivering strong financial results, the team accelerated our pace as a technology leader in electric and automated driving. The next chapter in our transformation will be revealed during the Mercedes-Benz Strategy Update in California on February 22 focusing on the Mercedes-Benz Operating System (MB.OS).“

Ola Källenius

Chairman of the Board of Management of Mercedes-Benz Group AG

Mercedes-Benz expanded its offering of battery electric vehicles to 9 cars and 4 vans, including the new EQS SUV and EQE SUV and most recently unveiled a new eSprinter. To scale manufacturing of zero-emission vehicles, the Mercedes-Benz cars and vans production network was retooled, and new deals with suppliers were struck. Mercedes-Benz will source battery cells from a new factory built by Contemporary Amperex Technology Co., Ltd (CATL) in Debrecen, Hungary. An annual supply agreement for an average 10,000 tonnes of lithium hydroxide from Canadian-German start-up Rock Tech Lithium Inc. was signed. In addition, Mercedes-Benz announced plans to launch a global high-power charging network across North America, Europe, China and other key markets.

The free cash flow of the industrial business rose to €8.1 billion (2021: €7.9 billion). The net liquidity of the industrial business rose to €26.6 billion (end of 2021: €21.0 billion). The Group’s investments in property, plant and equipment in the full year totaled €3.5 billion (2021: €4.6 billion*). Research & development expenditure amounted to €8.5 billion (2021: €9.1 billion*).

*In 2021, Daimler’s commercial vehicle business is included until the time of the spin-off and hive-down

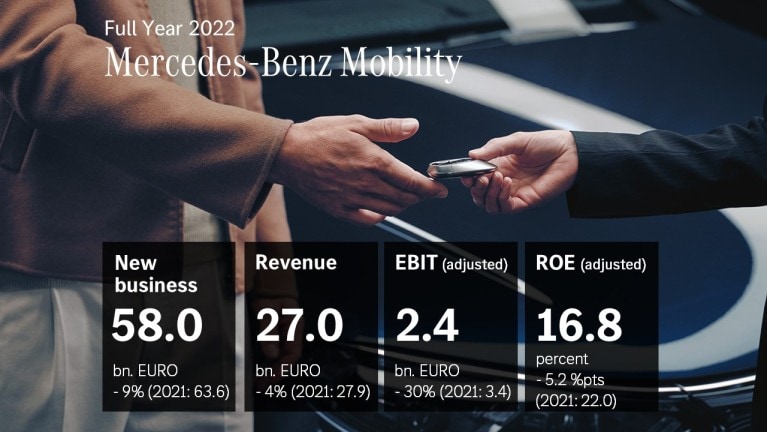

Mercedes-Benz Mobility saw new business decline to €58.0 billion (2021: €63.6 billion). However, the prior-year figure still included the new business from Daimler Trucks & Buses prior to the Daimler commercial vehicle business spin-off. At the end of 2022, contract volume amounted to €132.4 billion and was thus at the same level as at the end of last year (2021: €133.7 billion). For financed and leased electric and hybrid vehicles, Mercedes-Benz Mobility was able to significantly increase its contract volume, compared to end of last year. Overall, in 2022 adjusted EBIT decreased to €2.4 billion (2021: €3.4 billion), driven by the increase in cost of credit risk caused by a subdued economic outlook as well as higher refinancing costs and lower volumes following to the Daimler Truck spin-off. Consequently, adjusted Return on Equity (RoE) was below the last year’s level with 16.8% (2021: 22.0%).

In a challenging macroeconomic environment, Mercedes-Benz Cars sold 2,040,719 vehicles (+5%). In line with the strategy to focus on EVs, Mercedes-Benz had strong BEV sales of 149,227 units incl. smart (+67%). Sales in the Top-End segment increased by 8% driven by the S-Class (+6%) and additionally its all-electric version EQS, with more than 23,400 vehicles sold. Q4 marked the best sales quarter for this all-electric flagship. Furthermore, Mercedes-Maybach achieved a new record year with sales up 41%. Strong sales of C-Class, the top-seller GLC and the new EQE led to a rise in sales in the Core segment of 9%. The adjusted Return on Sales (RoS) for Mercedes-Benz Cars rose to 14.6% from 13.1% in the year-earlier period.

In the fourth quarter, deliberate decisions to make payments to selected suppliers and the impact of the so-called “inflation bonus” for eligible staff in Germany resulted in slight headwinds and an adjusted Return on Sales of a still high 13.4%.

At Mercedes-Benz Vans, full-year unit sales reached 415,344 vehicles worldwide (+8%), thanks to a comprehensive portfolio of commercial and private vans, despite the ongoing global challenges in the areas of parts supply and logistics. In the year under review, 15,000 eVans were sold (+15%), thereof around two thirds commercial eVans. The adjusted Return on Sales (RoS) for Mercedes-Benz Vans rose to 11.2% (2021: 8.3%). In 2022, the all-electric small vans eCitan and EQT [power consumption combined (WLTP): 18.99 kWh/100 km; combined CO2 emissions (WLTP): 0 g/km], were presented, so that the entire product range is fully electric. A few days ago the eSprinter had its world premiere.

At the Annual General Meeting on May 3, 2023, the Board of Management and the Supervisory Board will propose a dividend of €5.20 per share (2021: €5.00). For 2022 the total payout would amount to €5.6 billion (2021: €5.35 billion).

To optimise the company’s capital structure and to create value for shareholders, Mercedes-Benz announced a share buyback to repurchase own shares worth up to € 4 billion (not including incidental costs) on the stock exchange over a period of up to two years. The repurchased shares shall subsequently be cancelled. On the back of strong operating performance and continued strong cash generation the programme is scheduled to start in March 2023. The buyback will be funded by Mercedes-Benz’s expected future excess free cash flow and is fully compatible with the company’s strategic priorities and its dividend policy. Mercedes-Benz remains committed to a strong investment grade credit rating and targets an A rating by the major agencies. Further details on the share buyback programme will be announced separately prior to the start of the programme.

The global economy faces an exceptional degree of uncertainty regarding geopolitical and macroeconomic developments such as the war in Ukraine, the development of trade between China the European Union and the United States, and the further course of the COVID-19 pandemic. These may impact supply chains and the development of prices for raw materials and energy. In addition, continued inflationary pressure for consumers and companies and the associated central bank increases in interest rates, as well as a more pronounced growth slowdown in the economy, make the outlook more difficult. The worldwide shortage of semiconductors is easing, however individual issues remain, causing supply constraints.

Overall demand: In Europe, incoming orders are more sluggish, however the order bank supports sales into the first half of the year. In the United States, demand is seen on a good level. In China, the fourth-quarter COVID-19 effect has led to a spill over impact on sentiment in the first quarter. Momentum is seen returning post Chinese New Year, preliminary indications show.

The portfolio volume of Mercedes-Benz Mobility is seen slightly lower. The adjusted Return on Equity is seen in the range of 12% to 14% for 2023. This includes Operational Expenditures (OpEx) increases of the recently announced charging network.

The company is taking a prudent view and sees unit sales of Mercedes-Benz Cars at the prior-year level. Overall Top-End vehicle sales are expected to be slightly above prior year, thanks to new additions to the portfolio, including the new EQS SUV and later the Mercedes-Maybach EQS SUV. Sales of battery electric vehicles (BEV) are expected to approximately double. The adjusted Return on Sales (RoS) is expected in the range of 12% to 14%. Net pricing is expected to be slightly positive. Based on current assumptions it is targeted to compensate inflation-related cost increases, supply chain interruptions and one-time commodity charges. The used vehicle business is expected to be slightly negative versus 2022. Research & Development spending is expected to be slightly above the prior year. Investments in property plant & equipment are seen significantly above, mainly due to the MMA platform.

Total Mercedes-Benz Vans sales are seen flat and the adjusted RoS is seen in the range of 9% to 11%. Net pricing is expected to remain flat. Based on current assumptions, it is targeted to compensate inflation-related cost increases, supply chain interruptions, and one time commodity charges. Investment in property, plants & equipment and research & development spending are seen significantly above the prior-year level due to investments into the VAN.EA electric platform.

The Mercedes-Benz Group expects the Group's revenue in 2023 to remain at the prior-year level. In a market environment that remains challenging, the Group expects EBIT to be slightly below the previous year's level based on the development of the segments. The Mercedes-Benz Group expects the Free Cash Flow of the industrial business at the previous year's level in 2023. Higher tax payments are expected than in the previous year.

The Mercedes-Benz Group expects the average CO2 fleet of new passenger cars in Europe (European Union, Norway and Iceland) for 2023 to decline significantly compared to the previous year. With the further expansion of the fleet of electric vehicles, it can be assumed that the CO2 requirements in Europe will also be met in 2023.

More information: group.mercedes-benz.com